Gamechangers magazine-eleven-15

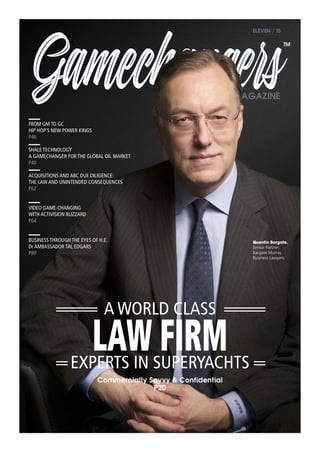

- 1. GamechangersMAGAZINE ELEVEN / 15 LAW FIRM Commercially Savvy & Confidential P20 FROM GM TO GC HIP HOP’S NEW POWER KINGS P46 SHALE TECHNOLOGY A GAMECHANGER FOR THE GLOBAL OIL MARKET P40 ACQUISITIONS AND ABC DUE DILIGENCE: THE LAW AND UNINTENDED CONSEQUENCES P62 VIDEO GAME-CHANGING WITH ACTIVISION BLIZZARD P64 BUSINESS THROUGH THE EYES OF H.E. Dr AMBASSADOR TAL EDGARS P80 Quentin Bargate. Senior Partner. Bargate Murray Business Lawyers A WORLD CLASS EXPERTS IN SUPERYACHTS TM

- 2. Gamechangers

- 3. WE MAKE YOU LOOK GREAT A custom publication is your organisations best marketing material, and we create great publications Email gamechangers@acq5.com to start a conversation about your custom publication.

- 4. Gamechangers 4 COVER WORLD VIEW CONTENTS 84 80 QUENTIN BARGATE. BARGATE MURRAY BUSINESS LAWYERS Leading Shipping and Maritime Law Firm Senior Partner discusses the changing face of maritime law. 20. 26. 30. 32. 38. 40. 42. 10 BEST AND WORST COUNTRIES FOR STARTING AND RUNNING A BUSINESS LONDON’S CORPORATE TECH BOOM Have we learnt past lessons? A GAME-CHANGER FOR THE GLOBAL OIL MARKET Over the past five years shale oil production has increased by a factor of ten in the USA. THE FUTURE OF ICT Brought to you by the world economic forum. UNIVERSITY OF EDINBURGH SECURES UK’S FIRST RISK AND RESILIENCE INNOVATIONS SHOWCASE SIBOS 2015: RENMINBI The real gamechanger GameChangers™ welcomes news and views from its readers. Correspondence should be sent to gamechangers@acq5.com For more information about GameChangers™ visit www.acq5.com/posts/gamechangers/ GameChangers™ Copyright © 2015 GameChangers™ No part of this magazine may be reproduced, stored in a retrieval system or transmitted in any form without permission. SAFE HARBOR The interviews in this publication may contain certain forward looking statements with respect to the financial condition, results of operations of the businesses profiled. These statements and forecasts involve risk and uncertainty because they relate to events and depend upon circumstances that will occur in the future. There are a number of factors which could cause actual results or developments to differ materially from those expressed or implied by these forward looking statements and forecasts. The statements may have been made with reference to forecast price changes, economic conditions and the current regulatory environment. Nothing in these announcements should be construed as a profit forecast.

- 5. 5 Gamechangers David Rogan - President & Editor-In-Chief Jon Van Dyke - Editorial Director James Wiltshire - Publisher EDITORIAL J Robson - Editor-At-Large L. B. Kooler - Deputy Editor T Gardiner - Senior Editor J LaRusso - Copy Chief M-C Fisher - Editorial Assistant B Sancheze - Senior Staff Writer ADVERTISING A Bott - Digital Advertising Director J Downey - Advertising Director Z Wolfel - Business Development Director C Thomas - Account Executive H Smith - Account Executive ADMINISTRATION A Kessler - Finance & Administration Director B McLaughlin - Technology Manager P Hughes - Operations Coordinator T. A. Black - Office Manager 20ARISEBEHIND THE BRAND TABLE OF CONTENTS 46. 50. 54. 56. 62. 64. 72. 76. 80. 84. 88.PRODIGY FINANCE. Innovations in global financing, with inbuilt social and financial benefits. DEVERE GROUP . Noble aspirations from one of the worlds largest independent financial advisory organisations. GBSH CONSULT GROUP Good Karma and advanced strategies, H.E. Dr Ambassador Tal Edgars tells his story. PENDO SYSTEMS. Pamela Cytron gives us a clear insight into her digital world; her motivations and keeping up in her fast paced industry. AL SAFAR. A careful balance of human nature and lawyers instincts have resulted in a 33 year longevity in strategic legal solutions. HIP HOPS POWER KINGS. Tackling perceived value in the music industry. We take a look at raps big hitters. MOST VALUBLE ATHLETE BRANDS & GAMECHANGING IN THE RUGBY WORLLD CUP Woods and Mickelson lead the pack. SIGNALLING CHANGE Sign manufactuing, your one-source re-branding solution. iDEAL STRAIGHT OUTTA HARVARD Ranking number one business school globally, it’s hardly surprising that it produces the cream of the crop. ACQUISITIONS AND ABC DUE DILIGENCE: The Law and unintended consiquences. COULD THE ACTIVISION BLIZZARD ACQUISITION OF KING LITTERALLY BE GAMECHANGING? Activision looks set to accelerate it’s strategic growth plan. TEAM

- 6. Gamechangers 6 Paperchase, the design-led stationery, greeting cards and gifts specialist, has secured a £50m refinancing package that will further support and enhance the company’s strong growth ambitions in the UK and internationally. The financing package includes a £32m six-year term loan from direct lending fund Permira Credit Solutions II and £18m of capex, revolving credit and ancillary facilities from Lloyds Bank Commercial Banking. Paperchase will remain under the ownership of Primary Capital, a leading provider of private equity to UK-based growth companies, and existing management led by chief executive Timothy Melgund. The debt investors have been attracted by the company’s strong trading and prospects for the future. In July the company announced a 33% increase in profit for the year ended January 2015 with EBITDA up to £9.6m and total sales up 7% to £128.0m. Ecommerce sales jumped 42% in the year. Paperchase is on course for another strong year with the current trading figures being ahead of expectations. During the last 12 months alone, Paperchase has launched in Canada through major department store chain Hudson’s Bay, the USA through stationery giant Staples and added a further 13 new standalone UK stores. It expects to open another five stores before the year end. Meanwhile, the company has seen its profile among customers grow exponentially since the launch of its Treat Me reward programme, which is on track for one million members in the first six months since the UK launch this summer. Timothy Melgund, Chief Executive, said: “We are delighted to have agreed this arrangement with two very well known funders. The debt will enable us to further build on the momentum in the business and continue to deliver our ambitious growth plans.” Dan Hatcher at Permira Debt Managers, said: “We have long admired Paperchase’s clear leadership in its market and its dedication to innovation and growth year after year. We are delighted to be part of that story with our European direct lending fund providing substantial growth capital to support the company’s ambitious plans.” Chris Birt, Director at Lloyds Bank Commercial Banking, said: “Having already built a clear identity and market share in both the UK and North America, Paperchase is now set to further develop its presence globally. The company’s impressive performance in recent years is testament to its ambitious management team and the catalytic qualities of private equity investment. This refinancing demonstrates our confidence in the business’ future potential as it builds on a flourishing online offering and some exciting new opportunities abroad.” Primary and management were advised by PwC Debt & Capital Advisory. Paperchase secures £50m refinancing package to boost growth FineFrance UK (“FineFrance”), an importer and distributor of premium food products to Michelin star restaurants, has been sold to Vestey Holdings Limited for an undisclosed strategic price. The transaction was originated and led by Gary Ecob and Steve Nock from Birmingham based corporate finance advisers Orbis Partners. Established in 1989, FineFrance operates across London and the South of England supplying into over 400 UK restaurants as well as the wholesale markets. FineFrance’s ability to combine high provenance premium products with exceptional levels of customer service has enabled the company to develop a high-quality customer base. The fine dining restaurant market demands traceability, speed of supply and focuses on provenance foods. FineFrance’s efficient and diverse supply chain allows its customer base to get next day quality fresh product sourced from mainland Europe. Vestey Food Holdings (“Vestey”) a £300m+ turnover group comprises 7 food companies, specialising in supplying, sourcing and distributing food products to 70 countries around the world. Following the sale of FineFrance majority shareholder Alain Nozahic said, “Having been involved in the business for over 14 years, I am delighted to have completed a deal that will enable FineFrance to enter the next stage of its growth. The advice and guidance received from Orbis throughout the process has been invaluable and has helped to deliver an excellent result for the shareholders.” Commenting on the transaction Gary Ecob, partner, from Orbis said, “I am delighted to have concluded a deal that recognises the strategic value of FineFrance. From an early stage we identified Vestey as a strong potential buyer due to its previous experience within the fine food sector and the complementary businesses within its Group.” Other advisers involved in the deal included Coffin Mew LLP, who provided legal advice to the shareholders. Orbis is a mid-market corporate finance house advising on a wide range of M&A transactions covering sectors such as Food & Consumer, Business Services, Industrials, TMT and Healthcare. Orbis is the UK partner for Clairfield International, a worldwide partnership providing cross-border mergers and acquisitions advisory. Orbis also has an active investment portfolio held through its investment vehicle, Intrinsic Equity. Baring Private Equity Asia (“Baring Asia”), one of Asia’s largest and most established independent private equity firms, has today completed the deal announced in May to acquire a majority stake in Vistra Group (following regulatory approvals). This change of investor from the previous majority stakeholder, IK Investment Partners (“IK”), does not affect the ongoing operations of Vistra Group, whose management team will continue to hold a significant shareholding in the company. Advising funds that manage more than USD9 billion in committed capital, Baring Asia runs a pan Asian investment program, sponsoring management buyouts and providing growth capital to companies for expansion or acquisitions, making it a perfect partner to support and enhance Vistra Group’s continued growth. Commenting on the completion, Martin Crawford, CEO of Vistra Group, said, “Our partnership with Baring Asia brings a new and exciting chapter for the Vistra Group. With their support, we can continue the success and growth of the firm to the satisfaction of our clients, our employees and our shareholders. We very much look forward to what lies ahead. “I would like to thank IK for their help in building the Vistra Group into the successful business it is today. Under their stewardship, we have become one of the global market leaders in our industry, of which we and they can be hugely proud.” Jean Eric Salata, Founder and CEO of Baring Asia, added, “Vistra Group has an impressive track record, which has resulted in its position as one of the industry leaders. We are delighted to be partnering with Vistra Group to build on its success and drive it forward into a new era.” Ranked among the top four corporate service providers globally, Vistra Group is a versatile group of professionals, providing a uniquely broad range of services and solutions. Our capabilities span across company formations to trust, fiduciary and fund administration services. Comprising two key brands, Vistra and OIL, the Group employs over 1,300 employees in 46 offices across 35 jurisdictions. Visit: www.vistragroup.com, www.vistra.com and www.oilglobal.com iDEAL BRIEF Orbis advises on sale of premium food importer FineFrance UK to Vestey Holdings Limited Baring Asia completes deal to acquire majority stake in Vistra Group

- 7. 7 Gamechangers Equiteq, a consulting sector M&A specialist, is pleased to announce the sale of Noah Consulting, LLC to Infosys Ltd. (NYSE: INFY) for an aggregate purchase consideration of $70 million. Equiteq principals acted as the exclusive financial advisor to Noah Consulting, an award- winning information management consultancy catering to the oil and gas industry. The transaction was announced on October 19, 2015, and is expected to close in the fourth quarter of calendar year 2015, subject to customary closing conditions. Founded in 2008, Noah Consulting is a provider of advanced information management solutions for the oil and gas industry with offices in Houston, TX and Calgary, AB. Noah’s deep domain expertise in upstream oil and gas, coupled with their tools, solution accelerators and proprietary methodologies, makes them a leader in driving strategic data management engagements. This acquisition combines Noah’s deep industry knowledge, information strategy planning, data governance and architecture capabilities with Infosys’ ability to provide technology and outsourcing services on a global scale to oil and gas clients. John Ruddy, President of Noah Consulting said, “We are excited about the new capabilities that the combination of Noah and Infosys will bring to our clients. Together, we can effect transformational change for our oil and gas clients by using information management to integrate supply chain, safety, environmental and financial data with geoscience, engineering and other operational and technical data – an industry challenge that has never been addressed effectively. We look forward to making a difference together.” David Jorgenson, Equiteq’s Global Head of M&A, commented, “Noah is a world-class information management consulting business that has developed differentiated capabilities and excellent client relationships in the energy sector. The company’s focus on disciplined growth has allowed it to expand significantly while still delivering margins above the industry average. The combination of Infosys and Noah will deliver exciting opportunities for their global team and provide their clients access to a broader suite of complementary service offerings. We thoroughly enjoyed working with Noah’s founders, John Ruddy, Shannon Tassin and Stewart Nelson, and congratulate the team on this exciting milestone for the business.” Shannon Tassin, Director and Co-Founder of Noah Consulting, added, “Equiteq’s appointment was driven by their specialist expertise as an M&A advisor in the consulting space. Their guidance through the process was invaluable as Equiteq demonstrated a strong ability to assess, explain and negotiate on behalf of Noah.” The Georgian Co-Investment Fund (“GCF”), a US$6B private equity fund based in Georgia, and AXIS, a leading Georgian construction company, officially announced AXIS TOWERS, a project to build the tallest twin skyscrapers in Tbilisi on Chavchavadze Avenue, at a presentation held on October 20th at the site of the construction. The presentation was delivered by George Bachiashvili, CEO of GCF, and Giorgi Kapanadze, General Director of AXIS; Irakli Garibashvili, the Prime Minister of Georgia, also addressed the audience. Members of the Georgian government, foreign diplomats, representatives of international organisations and financial institutions, as well as senior executives of major companies operating in Georgia were amongst the many attendees. GCF and AXIS shared information on the project’s economic and technical parameters with the audience. GCF acquired 50 percent of AXIS TOWERS while the other 50 percent is held by AXIS. At 147 meters, AXIS TOWERS will be the tallest skyscrapers in the capital of Georgia. The multifunctional complex consists of two 41-storied towers (4 of which are underground). One tower is glazed with dark glass; the other features white stone cladding. The total buildable area of the towers equals 94,000 m². The glass tower will house a 5-star Pullman hotel. Pullman is a high-end international French brand from the ACCOR Group, mainly targeted at cosmopolitan travellers and business tourism. The agreement between AXIS TOWERS and ACCOR Group was signed during the presentation. The tower will additionally feature an A-class business centre with 15,000 m² of office space. Meanwhile, the stone tower will comprise of 15,000 m² of residential property, featuring apartments with impressive views of Tbilisi. The tower will be equipped with all the necessary infrastructure to create the maximum comfort for its residents. AXIS TOWERS will offer its customers a wide range of options for recreation and entertainment. The skyscrapers will include several facilities such as: a fitness and spa centre; a 25-meter long swimming pool with a sliding roof; a Sky Bar on the top of the towers with panoramic views of Tbilisi; a 1,100 m² concert hall; a shopping mall, several restaurants and cafes. The AXIS TOWERS project will feature an underground car park area with capacity for 500 vehicles. As part of the project, a new street connecting Chavchavadze Avenue and Abuladze Street will also be developed which will house a recreation area with a number of cafes and restaurants. This will improve pedestrian access in Tbilisi and the street will become a place where residents and tourists can gather and meet. Since the creation of the AXIS TOWERS concept, Georgian specialists have worked in cooperation with international experts and representatives of major global brands such as the leading global engineering firm Arup Group on every step of this project. The audience at the presentation was able to see a special documentary feature on AXIS TOWERS, which illustrated the cooperation between AXIS and other international and local partners involved in the project. The General Director of AXIS, Mr. Giorgi Kapanadze commented: “AXIS TOWERS is an unprecedented project in terms of its scale and functionality. This is a multi-functional complex which includes five directions of development as the skyscrapers will house high-level residential, office, commercial and entertainment areas as well as a 5-star Pullman hotel. AXIS continues to play an important role in advancing Georgia’s industrial development and we are especially proud that AXIS TOWERS will be the new landmark of Tbilisi. The project was renewed in cooperation with the Georgian Co-Investment Fund and is progressing actively. I am pleased to announce that residential areas at AXIS TOWERS go on sale today. THE CEO of GCF, Mr. George Bachiashvili commented: “TheAXIS TOWERS project is fully in accordance with the mission that the Georgian Co-Investment Fund seeks to fulfill. By implementing this project with AXIS we are investing US$83 M in Georgia’s economy. At the same time, we are supporting the further development of an already successful Georgian company, AXIS. We are also utilising the expertise of the international industrial leaders through our work on this project and creating a range of new local jobs. “We are glad that the Georgian Co-Investment Fund played a crucial role in making this project happen: with ours and AXIS’ efforts several months ago, we were able to renew a project that had stalled for 7 years. Now, the project is expected to be completed in 2017. We are confident that AXIS TOWERS will be an outstanding project in terms of its architecture, scale and quality of construction, incorporating best global industry practices. It will set a new standard in real estate not only for Georgia but for the wider Caucasus’ real estate market.” The Prime Minister of Georgia, Mr. Irakli Garibashvili said: “The development of the hospitality and real estate sectors is a very important element in ensuring Georgia’s continued economic growth. The public had a chance to get acquainted with the impressive AXIS TOWERS project today, and this will play an important role in this development. I would like to mention with pride that this is another interesting and exceptional Georgian project which represents a new statement in modern Georgian architecture. My compliments go to AXIS for the role it plays in developing the construction industry in Georgia. This company is always outstanding with its innovative, quality solutions. I would also like to emphasize the GCF’s continuing role in supporting Georgian businesses. GCF’s involvement made it possible to restart the project in 2015 and as a result of AXIS and GCF’s successful partnership, Tbilisi will acquire a unique multi-functional complex in 2017, which will attract FDIs, create additional revenue for the central budget, support the development of business tourism and create jobs for hundreds of people.” iDEAL BRIEF AXIS and Georgian Co- Investment Fund to build “Axis Towers”, the tallest skyscrapers in Tbilisi Equiteq sells Houston- based information management consultancy to Infosys

- 8. Gamechangers 8 Corporate Group Advises Custodian Reit Plc On A Fundraising To Raise Up To £75 Million Corporate lawyers at Walker Morris have advised the commercial real estate investment company, Custodian REIT Plc, on its proposed fundraising to raise gross proceeds of up to £50 million, with the ability to increase this to up to £75 million. The funds will be raised through the issue of up to 71,976,967 new Ordinary Shares by way of a Placing, an Open Offer and an Offer for Subscription, all at 104.2 pence per Ordinary Share. In addition, the Company is facilitating potential issues of up to 100 million further Ordinary Shares pursuant to a rolling 12 month Placing Programme. The funds will be used to capitalise on current opportunities to invest in commercial real estate properties in the UK to add to its existing portfolio of 101 assets. Custodian recently entered into non-legally binding heads of terms to acquire a portfolio of 11 UK commercial properties for an aggregate consideration of approximately £69.4 million. In addition, the Company has committed pipeline investments and other opportunities. Richard Naish (partner), Jon Wharam and James Goose from the Walker Morris Corporate Group advised Custodian. Richard Naish said: “As a firm we have had an extremely busy year in terms of public market deals which is testament to both changing market conditions and our reputation in this specialist field. This latest deal provides Custodian with a solid platform to expand their property portfolio and achieve their growth ambitions.” Numis Securities acted as sponsor and broker to Custodian REIT Plc, advised by Travers Smith (Aaron Stocks). BULLDOG London Dry Gin announced that Farlap Partners, a UK-based principal investment firm, has agreed to make a minority investment in BULLDOG. Farlap Partners will become one of BULLDOG’s largest shareholders after this transaction. Farlap will work with BULLDOG’s management team to continue expanding the brand and building the business both domestically and internationally. BULLDOG Founder and Chief Executive Officer, Anshuman Vohra, said, “This transaction represents a major step up in our financial strength and comes on top of recent major distribution and route to market gains for BULLDOG, which today is a top 5 premium gin worldwide. Farlap has deep relationships and a coveted investor base. They will be a fantastic investment partner and we look forward to building the next few chapters of BULLDOG with their help.” Farlap Managing Partner, Karan Chadha, said, “Having followed BULLDOG since its inception, we are confident that BULLDOG - as the highest quality product in its category - will continue its meteoric rise around the world. Farlap, along with our investment partners, has a strong history of helping companies expand globally, and we are thrilled to partner with Mr. Vohra and fully support his vision to continue to disrupt the existing order and reshape the global premium gin landscape.” BULLDOG London Dry Gin is today the fastest growing gin in the world and available in 80 plus countries on all continents. As a leader within the super-premium gin space, BULLDOG currently occupies the leading position in several important markets around the world. Polaris Private Equity (Polaris) divests its holding, equivalent to 75 percent of all shares, in Skånska Byggvaror to Byggmax. Byggmax pays a consid- eration of SEK 741 million for all the shares in the company. In addition to the initial purchase price there is a possibility to get an additional payment of SEK 110 million, based the financial performance for Skånska Byggvaror during 2016. Skånska Byggvaror is an online based retailer of refined do-it-yourself products. The Company has operations in Sweden and Norway with an assortment focused on the building’s interior and exterior environments, ranging from win- dows and doors to storage and conservatories. Over the past 12 months Skånska Byggvaror had net sales of SEK 690 million, growing by approx- imately 20 per cent year-on-year, and EBITA of SEK 47 million (excluding nonrecurring items). “During the autumn we have prepared a change of ownership where a sale to a larger industry player has been an option. This is an attractive deal for all parties, in which Skånska Byggvaror is able to continue to develop under its own brand, but from Byggmax’s strong Nordic plat- form. This is an important deal for Polaris and we are proud of the company’s development under our active ownership.” says Peter Ankerst, Polaris Private Equity. Polaris acquired Skånska Byggvaror in 2012 and has since then worked actively with the company’s omni-channel strategy, including the establishment of six physical stores - four in Sweden and two in Norway. The product range has also been expanded, which combined has resulted in an increased annual average growth rate of 20 percent, with good profitability, the Polaris Private Equity divests Skånska Byggvaror Farlap Partners Announces Minority Stake In Bulldog Gin past three years. “We are impressed by Skånska Byggvaror’s ability to grow turnover over time, while the company has been profitable. We see significant synergies between the companies, mainly that we can benefit from each other’s assortments to boost sales. Skånska Byggvaror’s conservatories, which they assemble and sell under their own brand, is their largest category. Conservatories have positioned Skånska Byggvaror as a strong brand that combines good quality with low prices. The market for conservatories is expected to have good growth in the foreseeable future. “Says Magnus Agervald, CEO Byggmax Group. “Together with Byggmax we get an opportu- nity to extend our offer and at the same time increase our sales through Byggmax strong presence on the Nordic market. We know that our customers purchase building material when they finalize their DYI-projects and we are happy to be able to provide this in the future. We look forward to continue our journey and strengthen our brand together with Byggmax.” says Anders Johansson Eickhoff, CEO of Skånska Byggvaror. Potential additional purchase price is based on Skånska Byggvaror’s financial performance during 2016. The transaction is subject to approval by the Competition Authority. The transaction is expected to be completed in the fourth quarter 2015. Skånska Byggvaror Polaris Private Equity have been advised by Carnegie and Mannheimer Swartling and Byggmax has been advised by Danske Bank, Lindahl and EY. iDEAL BRIEF

- 10. “Gamechanger: What we define as an individual or business that aims to create a new model that leaves the older model obsolete. Gamechangers impact how the game is played from one objective and ruling model to a completely new vision – changing the face of how we know something.” Gamechangers 10

- 11. Nicola Horlick to supercharge pension-led funding Horlick gets behind SME funding solution that has potential to provide £100bn of finance through investment from the pension funds of directors and business owners… Money&Co. CEO, Nicola Horlick, has been appointed a non-executive director of Pension-led funding specialists, Clifton Asset Management. Horlick, who launched crowdfunding platform Money&Co. in April 2014, will help to guide Clifton through its next phase of growth. The company facilitates investment into SMEs from the pension funds of directors and business owners. It also operates the website www.pensionledfunding.com Clifton won the Best Alternative Funding Provider Award in 2014 and is one of the largest providers of alternative business finance in the UK having facilitated more than £250 million in funding to more than 1,500 businesses. Nesta 11 Gamechangers research found that almost two-thirds of SMEs using Pension-led funding saw their profits rise - and almost half employed more people. Horlick has been a leading fund manager in the City of London for over 30 years. During that time, she has set up and managed several investment businesses. Money&Co. has a shared interest with Clifton as it provides loans to SMEs looking to grow their businesses. Adam Tavener, Chairman of Clifton Asset Management said: “We’re delighted that Nicola has decided to become a non-executive director of our company. Her huge experience in the City and more recently in the alternative funding market will undoubtedly benefit both Clifton and Pension Led Funding” Nicola Horlick added: “I get approached for non-exec roles almost every week, but what particularly attracted me to Clifton was that Pension-led funding is something that is genuinely original and disruptive in the pension space. “Pension-led funding has the potential to become a much more mainstream funding solution for SMEs – particularly as the government, through pension freedom, has changed the mind set of not touching your pension until retirement. As a result, we are seeing a new wave of entrepreneurs turning to their pension funds for growth capital.” Clifton’s Pension-led funding solution is aimed specifically at business owners and directors who have accumulated pension funds greater than Michael O’Higgins appointed as LLPP Chairman The Lancashire County Pension Fund (LCPF) and London Pensions Fund Authority (LPFA) today announced that the former Chairman of the Pensions Regulator, Michael O’Higgins, will chair their £10bn partnership. The London and Lancashire Pensions Partnership (LLPP) will pool LCPF and LPFA assets, jointly manage the liabilities of the two administering authorities and offer pension fund management as a fully-fledged pension service organisation. Crucially, it will allow both Funds to maintain their local accountability with LCPF Pension Committee and LPFA Board maintaining control of key strategic decisions. Speaking about the appointment, Leader of Lancashire County, Jennifer Mein, said: “As we await the Government’s announcement of their criteria to assess proposals for pooling LGPS assets, we are moving forward at pace. Michael’s vision and experience are welcome assets, which should give others confidence in the seriousness of our joint endeavour, as we work towards launching the new company in April 2016.” LPFA Chairman, Sir Merrick Cockell, added: “Michael is highly respected in the public and private sectors as well as academia. His experience is invaluable as we develop this unique and ground-breaking partnership and we look forward to working with him. To have a person of Michael’s calibre chairing the partnership £50,000. They don’t need to be 55 or over, and should there be more than one owner director in the same firm, the pension funds can be amalgamated to invest in the business. Adam Tavener continued: “Pension-led funding has huge growth potential. Many entrepreneurs and business owners have been forced to personal guarantees, often putting their family home at risk. Pension-led funding allows business owners to invest in their businesses and potentially create a larger pot of money for their retirement if the business succeeds.” Clifton launched pensionledfunding.com to provide an online resource to business owners and their advisers. The site explains how pension-led business works and illustrates this with a number of case studies. 3.1m SME owner managers in the UK have a private pension pot. The National Office of Statistics calculated the average private pension pot is £25,000. Over its 20 years of working with SMEs Clifton has found the average SME owner pension pot is, in fact, £75,000 (3.1m x £75,000 = £232bn). Therefore, far more than £100bn of finance could be sourced directly through director/business owner pension funds. Nesta surveyed 15,658 people from March to September 2014 for Understanding Alternative Finance, The UK Alternative Finance Industry Report 2014. Nesta is an innovation charity that helps people and organisations bring the best out of their business through alternative funding. is a real testament to what we are trying to achieve. “He has had a distinguished career spanning the academic, private and public sectors. He has a wealth of knowledge about the UK pension sector following his time as Chairman of the Pensions Regulator, serving two terms as a Non-Executive of HM Treasury and writing extensively on pension reform during his academic career.” Michael will be joined on the LLPP Board by Deputy Leader of LCC, David Borrow as the LCC representative and Skip McMullan as the LPFA Board representative, as well as three new independent Non-Executive Directors to be appointed shortly. Commenting on the appointment, Michael O’Higgins said: “I’m delighted to be involved with Lancashire and LPFA as they embark on this ambitious project that could completely change the face of the public sector pension industry. I applied for this role because I believe what Lancashire and London are doing with this partnership is exactly what should happen across local government, and indeed the wider pension sector, to help secure better benefits for members. “My first task will be to recruit a Board to support this and in order to ensure the governance capability to deliver the ambitions of the Partnership.” Michael will commence in the role with immediate effect. MOVES

- 12. Gamechangers 12 Elian appoints Chief Commercial Officer and Head of Elian Corporate Services Elian has made two strategic changes to its senior leadership team. Philip Norman, who has been with the business for 16 years, has been appointed Chief Commercial Officer and promoted to the Elian board. A key priority for Mr Norman will be the continual development of new products, driving business growth and market share, whilst at the same time maintaining high levels of client service across the globe. Gridiron Capital announces promotion Mr. Gault’s responsibilities since joining Gridiron have grown to include sourcing and evaluating potential investment opportunities, performing due diligence, and participating in the structuring, negotiation, financing and closing of portfolio investments. While at Gridiron, Mr. Gault has helped close a wide variety of platform and add-on acquisitions. He is also a Director on the Boards of several Gridiron portfolio companies including Quality Solutions, Executive Cabinetry and LRS. Prior to joining Gridiron Capital, Mr. Gault worked in investment banking with Lehman Brothers, based in New York, NY, as a member of the firm’s Global Financial Sponsors Group where he worked extensively with Sponsors in the consumer, retail, industrial, media and healthcare industries. Mr. Gault graduated with a B.A. in history from Dartmouth College. Mr. Gault also holds an M.B.A. from the Kellogg School of Management at Northwestern University. Tom Burger, Managing Partner of Gridiron Close Brothers Asset Finance expands manufacturing team Close Brothers Asset Finance, part of the com- mercial division at Close Brothers Group, today announced the appointments of Simon Duck- worth and Ben Coldwell as area sales managers to its mid corporate team in the manufacturing division. Close Brothers Asset Finance offers a range of flexible of funding options including hire purchase, leasing and refinancing. As a member of the Close Brothers Group, Close Brothers is a leading UK merchant banking group providing lending, deposit taking, wealth management services, and securities trading. Simon Duckworth joins as area sales manager for the southern region. Having worked in financial services for over 20 Group director Simon Mackenzie, who joined the firm in 2002, has been appointed Head of Elian Corporate Services. Mr Mackenzie will lead Elian’s corporate services business, focusing on further integration and expansion. The business provides bespoke administration services to corporate and institutional clients across all of the global markets they operate in. Mr Mackenzie has extensive experience specialising in the administration of complex corporate owned structures both offshore and onshore. He takes over as head of Elian Corporate Services from Mr Norman. Elian Chief Executive Officer Paul Willing said: ‘Philip and Simon play integral roles within Elian and thoroughly deserve their promotions. We have had an exciting first year as Elian. We have expanded our footprint in North America and continental Europe with our new office in New York and with the acquisition of SFM Europe. We have very exciting growth plans and Philip’s team will be vital in helping us expand and grow the business in new markets and geographies. Simon is a highly skilled and respected corporate services professional and the ideal person to lead Elian Corporate Services as it continues to develop its global platform. These strategic appointments allow us to continue our relentless pursuit of client service excellence and provide Elian with the leadership to take the business to the next phase of its development.’ Specialists in Corporate Services, Fund Services, Private Wealth, Capital Services and Due Diligence Services, Elian has a clear, uncompromising vision: to continually deliver more value by raising the bar in Administration services. We work with global law firms and accountancy firms, multi-national corporations, financial institutions, high net worth individuals, family offices and fund managers and believe that the best can always be better. With over 500 professionals across a network of 11 international offices, covering all time zones and key financial centres, we are experts in handling large, demanding and complex engagements. From our technical skills and market understanding, to the personalised service we give our clients, we are always looking to set new industry standards by challenging standard practice. Elian’s network of offices comprises of Bahrain, the British Virgin Islands, the Cayman Islands, Dublin, Guernsey, Hong Kong, Jersey, New York, London, Luxembourg and Tokyo. Visit: www.elian.com said, “Josh has been a valuable member of the Gridiron Team. Josh joined Gridiron back in 2007 as a Pre-MBA Associate, went back to business school, and rejoined Gridiron after completing his MBA at Kellogg. He is a pleasure to work with and he brings value in acquisitions and in working with our portfolio companies to drive growth and value. Josh has consistently taken on more responsibility since joining the Gridiron Team and we look forward to his continued success at the firm.” years, Simon’s most recent experience position was as business development manager for Lom- bard.He arranged complex financial agreements for customers and managed a successful sales team, and this has provided a great commercial platform for his new role. Simon believes his knowledge of manufacturing and a wide range of financial products will be advantageous to his new role with Close Broth- ers Asset Finance. He commented: “I am excited to be entering this new chapter in my career, and I am pleased that I have joined an ambitious and highly motivated team, with a clear focus on supporting UK manufacturing.” Ben Coldwell joins as area sales manager for the northern region Ben is a credit-qualified asset finance business development manager with five years’ asset finance sales experience with Lombard, and seven years in business banking with RBS / Natwest group. He has a strong background in the industry, arranging finance for SMEs across a range of hard and soft assets. Ben said “I am delighted to be joining the team. It is a great opportunity and I am pleased to join a team that share the vision and desire I have in supporting UK businesses with their capital expenditure plans and requirements.“ Managing Director of Close Brothers Asset Fi- nance Manufacturing division Ian Barker added: “We pride ourselves on our ability to understand what our customers are looking for, and so these key appointments really strengthen our team. The experience and knowledge that both Simon and Ben have in this field will be a real asset to our business.” MOVES

- 13. 13 Gamechangers David Hunter appointed as Senior Adviser for European Real Estate by H.I.G. Capital H.I.G. Capital, LLC (“H.I.G.”), a leading global private equity investment firm with 17 billion of equity capital under management, is pleased to announce the appointment of David Hunter as a Senior Adviser for European Real Estate. With more than 40 years of experience, David is a leading figure in the European Real Estate Industry. Prior to setting up his own independent real estate advisory firm in 2005, he was Managing Director of Aberdeen Asset Management’s £6.5bn property fund business and was President of the British Property Federation in 2004. Since then, he has held a variety of roles in both quoted and private property funds. H.I.G. Capital’s real estate platform targets small/midcap opportunities with a meaningful value-added component. With resources based in offices in London, Madrid, and Milan, the H.I.G. European real estate team is active across a wide spectrum of real estate asset classes. It has completed 21 transactions across multiple jurisdictions in Europe since the beginning of 2013 including in the U.K., Spain, Italy, the Netherlands, Finland and Portugal. With the ability to invest in all parts of the capital structure, H.I.G. Capital is able to develop creative financing solutions and consummate transactions on an expedited basis. Typical investment size ranges from 10 million to 100 million. In commenting on the appointment, Sami Mnaymneh, Founder and Co-CEO of H.I.G., noted, “I am delighted to welcome David as an adviser to the firm. He is a very experienced and successful real estate investor who significantly augments the expertise and capabilities of our team. I am confident he will play an instrumental role in H.I.G. Capital’s continued success in the European real estate sector”. David Hunter commented, “I am delighted to be working with H.I.G.’s team. I am truly impressed by their success in sourcing and closing such Partech Ventures appoints Olivier Schuepbach as new partner for Germany The March 2015 announcement that Partech Ventures would expand its presence in Germany is followed by actions: Olivier Schuepbach is ap- pointed partner of Partech in Germany and will lead the team of three investment professionals based in Berlin. Schuepbach is well-known among the German start-up scene: In the past he has already worked as a venture capitalist at Wellington Partners and has operationally helped start-ups such as Brands4friends, in its international expansion and ultimate sale to eBay. Partech’s managing partners Philippe Col- lombel and Jean-Marc Patouillaud gave a warm welcome to the new arrival: “We want to raise our exposure in Germany to the next level. With Olivier we gained a well-known and widely appreciated business partner to reach that goal,” explains Collombel. Patouillaud added that “Germany has a strong entrepreneurial scene which needs further growth capital and fully dedicated teams to unlock its potential. Investors in place must know the local market from inside out and have the right instincts to identify the rising stars. Olivier truly brings the experience and network we’ve been searching for.” With Schuepbach, the transatlantic venture capital firm appoints an experienced entrepre- neur and investor in the German and interna- tional technology scenes. Schuepbach started his career in the U.S. at Texas Instruments and has been working with fast-growing technolo- gy companies for more than 15 years. Prior to joining Partech Ventures, Olivier was in charge of international development and M&A at Brands4friends before eventually leading its successful exit to Ebay. Previously, he worked at the venture capital firm Wellington Partners where he teamed up with Partech for example on an investment in Qype, which was later sold to Yelp. A passionate entrepreneur and investor, Schuepbach is also known for his role as CFO of MarkaVIP, now one of the largest ecommerce companies in the Middle East. Born and raised in Switzerland, Schuepbach moved to Munich nine years ago. He has a very deep understanding of the German technol- ogy ecosystem from Berlin to Bavaria and is looking forward to actively supporting it: “With our transatlantic and pan-European structure and investment tickets ranging from 250,000 to 40M, we are in a position to accompany ambitious entrepreneurs in every phase of their growth.” Partech will invest in Germany through three funds: Seed (Partech Entrepreneur), Venture (Partech International) and Growth Capital (Partech Growth). Olivier will work in close prox- imity to principal Otto Birnbaum, who has been an active investment professional in the German Partech office since 2014 and who will focus on seed investment. Visit: http://www.partechventures.com/ Blandine Fauran joins De Gaulle Fleurance & Associés as a new partner Blandine Fauran, so far Legal and Compliance Director of the LEEM (the French pharmaceutical companies association) just joined De Gaulle Fleurance & Associés in order to reinforce the Health and Life Sciences practice. De Gaulle Fleurance & Associés thus strengthens its capacity to assist its clients facing challenges arising from the evolution of the legal framework applicable to health products and, more particularly, e-health, product compliance and security. Drawing on her experience in issues impacting pharmaceutical companies and in the legal and regulatory evolutions of the sector at both national and European scale, Blandine Fauran shall bring her knowledge of regulation, competition, ethics and compliance. Blandine Fauran: « Transformations of innovation in the drug sector and new multi- technology health solutions make news. I shall therefore assist companies commercializing health products, biotechs and organizations operating in this sector ». Since the beginning of her career in 1989 at the French national union for the pharmaceutical industry (SNIP), Blandine Fauran has supported the development of the union, which became the LEEM in 2002, and climbed the professional ladder up to the head of the then created Legal and Compliance Department in 2003. Blandine wrote numerous publications relating to health law. Blandine Fauran holds two postgraduate degrees (DEA) in European law and in business and economic law (University Paris I Panthéon Sorbonne, 1984 and 1986). Visit: http://www.degaullefleurance.com/en/ MOVES

- 14. GamechangersGamechangers 14 “A Gamechanger changes the way that something is done, thought of or made; they transform the accepted rules, processes, strategies and management of business functions. They shift behaviour, shape culture and make clever happen.”

- 16. Panasonic ‘Future Mirror’ You might have seen it already a prototype of this cool interactive mirror at the CES in January, but the one being shown in Germany is an improved version. Not only it can digitally enhance your face to show you how you would like with different makeups (in my case, with different types of beard, or moustache) and detect your skin conditions and recommend how to improve it, but now includes features such as vital statistics check, magnifier and rear view of yourself. A must-have, for all narcissists, when and if it will be marketed. A Glow-In-The-Dark Smartphone French smartphone manufacturer Wiko might not be a behemoth like Samsung or Apple, but it is doing well for itself, carving a niche in the market with quality products that offer good value for money. At IFA, it announced the latest collection of mobile devices. Some of them immediately available, others set to be launched in Autumn. To this second bunch belongs the Wiko Fever, a $199 iPhone looking device with 13-MP camera, 5.2” display, 5-megapixel front camera for quality selfies and octa-core 1.3 GHz processor. But its distinctive feature is that luminescent glow that makes it easier to find it at night or inside your bag. Gamechangers 16 PARADE

- 17. Ultrasound Images Via A Mobile App Among many other things, Philips introduced at the IFA, Lumify, an app-based ultrasound solution that offers high-quality imaging on a compatible smart device. It is sold through a subscription model, and is intended mainly for healthcare professionals, but it has a consumer side. It could be used for instance by women waiting for a baby to take ultrasound images of the fetus and send them to the doctor. Users can have access to an online portal where they can manage their device and access Philips’ support services. As for availability, the Lumify will be marketed in the U.S. later this year, but not in Europe. 17 Gamechangers A PC In A Stick Among the many products announced by Asus at the fair, one of the most interesting is the VivoStick PC, an ultra-miniature PC that turns any HDMI-enabled TV or monitor into a fully-functional Windows 10 PC (provided you add a keyboard and a mouse), and which can also be controlled remotely from a smartphone. It costs $129, and for that price you get 2GB of RAM, 2 USB ports, 32GB of storage, and a headphone jack. Unfortunately, it’s still unclear when it will go on sale. PARADE

- 18. Ricoh Pherical HD Camera Ricoh unveiled a new fully spherical portable camera, an improved version of its previous m15 model. It can capture high-resolution spherical images of up to nearly 14 megapixels and it can also record spherical video in full HD with a maximum recording time of 25 minutes. Images can then be shared on social networks or sent to Google Maps or Google Street View. It does not come cheap, the base sale price is $349, so if you’re thinking of just using it for group selfies, you might want to reconsider your ambitions. Pebble Time Pebble kicked off the smartwatch category—and with the Apple Watch looming, it’s not backing down from the fight. Today the company unveiled its next-generation product, which includes a color screen, thinner design and microphone, allowing you to interact vocally with the device. Pebble Time is compatible with the more than 6,500 apps that exist for the current Pebble Watch. As with the original, the company turned to Kickstarter to launch the device, selling it for $159. I doubled its campaign goal of $500,00 in just 33 minutes. After the campaign ends, the price will jump to $199. Gamechangers 18 PARADE

- 19. d n e n It 00 n 19 Gamechangers LG Twin Wash Admittedly more home appliance than digital home, the LG Twin Wash is nevertheless my favorite find at CES this year. It’s essentially a washing machine within a washing machine. There’s space for a full-size load on top, and a smaller, pull-out drawer on the bottom allows you to wash a second load simultaneously, so that you can get through the dreaded laundry day in half the amount of time. Digitsole Fitness trackers don’t have to live on your wrist. Digitsole is an insole for your shoes that can keep better track of your daily steps (and, presumably, calories burned) and even keep your feet warm. The $200 soles transfer data via Bluetooth and, as a bonus, add a layer of padding in your footwear to absorb shock and vibrations as you walk and run. PARADE

- 21. 21 Gamechangers “ “ Quentin Bargate, Senior Partner at Bargate Murray Solicitors AS ONE OF THE LEADING UK SHIPPING AND MARITIME LAW FIRMS, BARGATE MURRAY STANDS OUT STRONGLY REPRESENTING THE EVOLVING SUPERYACHT INDUSTRY. IN THE MID-SEVENTIES YACHT WORK WAS RARE COMPARED TO THE FINANCING OF BULK CARRIERS AND OTHER VESSELS BUILT BY EUROPEAN YARDS - THE PAST TWO DECADES HAVE SEEN THE DEVELOPMENT OF THE ONCE MODEST YACHT, INTO THE VAST SUPERYACHTS AND NOW MEGA-YACHTS THAT EXIST TODAY. I think the root of our success has been a joint emphasis on the quality standards that we insist upon, and the personalised way in which we deliver our services. We also have a young, talented and highly driven team that believes in those principles Q. As a partner in shipping and maritime law firm Bargate Murray, can you tell us about yourself? I have a great passion for the law, and the intellectual challenges it presents but, first and foremost, I am a devoted family man. I have three outstanding sons that are at the centre of my life and of whom my wife Glynis and I are very proud. Q. What motivated you to launch yourself into law? I like the challenge of complex intellectual problems and finding ways to solve them. I also pride myself on my understanding of the English language and enjoy using it to its fullest extent. Q. Do remind us and for those who don’t know, what does being a superyacht lawyer entail? The work is complex and international in its scope. When you think that, essentially, a superyacht is a highly complex construction project that is subject to international regulation and control, along with the laws of whichever jurisdiction it may be visiting at any given time, you begin to see what I mean… Q. What was it that initially interested you in the superyacht industry? I was initially attracted to the industry through instructions I received from existing clients’ interest in investing in yachts. I was, at that time, already a maritime lawyer and yachts just seemed to be a fascinating and exotic subset of maritime law. Q. With the launching of Triple Deuce, the world’s largest superyacht at a whopping 728ft in length, there’s clearly a consistency in eclipsing for their billionaire owners. Putting aside harboring issues, is there a point where these “floating palaces” become too big? In my view, the answer is probably yes, but then I am not a potential yacht builder or owner! There is, and has been for some time, a certain cache associated with being the owner of the world’s largest yacht, so I do not see this trend of ever-bigger yachts ending any time soon. That said, I hope that todays yacht owners also embrace technological advancements with newbuild yachts, making them ever more sophis- ticated as well as simply larger. Also, I hope to see the adoption of greener technologies. Q. With 223 sold already so far in 2015, 81 orders placed and an impressive 115 launched putting 2015 on an increase from last year’s progress already, we can see that the superyacht industry is vastly expanding. What does the future hold for superyacht acquisitions and trade? I don’t believe we have even scratched the surface of the potential of superyacht ownership globally. I believe there is great potential for further expansion, not only in superyacht ownership in the developing parts of the world, but also in the associated development of mari- nas in new cruising destinations. Q. With the majority of the globe’s superyachts being flagged within Europe and Central America, it was recently reported that China (now the world’s largest economy) possess a minute 0.7% of the world’s 4,836 superyachts – in your opinion, why are there so few flagged throughout Asia and Africa? Does the sheer volume of piracy across the two continents have any impact on this? I’m not sure it’s correct to say that the majority of superyachts are flagged in Europe. Red ensign flags such as Cayman and Bermuda ac- count for a very substantial portion of the world’s superyacht fleet. There is a good reason for this, namely long experience and expertise. Nonethe-less, I do see a greater role for alternative flag jurisdictions provided this does not adversely impact upon quality. I don’t believe the risk of piracy is a material factor at this time. COVER

- 22. Gamechangers 22 Q. What are your most recent highlights as a firm at Bargate Murray? We have taken on some fabulous new clients in 2015, which I put down to the strength of our team. This has been one factor in the continuing development and success of some of my more junior colleagues, with Mark Needham, my former Senior Associate being promoted to Partner in September. Q. You have previously said that you’re very much a family man, how do you balance the sheer intensity that comes as a superyacht lawyer with family life? I find my role as a superyacht lawyer is a cathartic experience because I get so much satisfaction out of the work I do, and the clients I meet. I try to bring that positive energy into my family life; my family knows that I enjoy my work and they are very supportive so I try to make sure the time I spend with them is valued. Q. The launch of Bargate Murray’s new Property Department is an exciting prospect; please tell us more about this… Given our UHNW client base, this seemed like a natural progression for the firm and, whilst it is very much in its infancy by comparison to our superyacht practice, our experience and knowledge is growing daily and we look forward to taking on ever bigger and more complex cases in the future. Q. Is this a preview of what’s to come for Bargate Murray; currently standing as a boutique law firm, are there any more plans to branch? I think our “boutiqueness” is actually one of the key factors that set us apart from our competitors, so that is factored in to any discussions my Partners and I have regarding growth. Put another way, we are not dead set on “growth for growth’s sake”. It will only be considered if we take the view that it will improve the quality of our business, not dilute it. Q. When we last spoke we focused solely round Bargate Murray and the super yachting industry. With 14 years of experience as a partner at your previous firm, what do you feel that you took from your time at Simmons and Simmons that has transferred into the success of Bargate Murray? Commercial savvy. There is no substitute for experience, a point often lost in a world driven by an obsession with youth culture. Q. As head of the Superyacht Group as well, in your opinion, what are the common struggles within the development of yachting? One thing I have noticed is the struggles that yacht class regulations seem to have to keep up with ever-larger yachts. The large yacht code, for example, mandates that the maximum number of guests a yacht can accommodate is 12, but in a time when yachts regularly exceed 100m in length, this seems unduly restrictive. That said, the introduction of the Passenger Yacht Code, which permits the carriage of up to 36 guests, might go some way to assuaging the problem. Q. As an advocate for ADR, what experiences do you feel influenced you to take preference to this approach? If I’m honest, litigation is little more than a lottery and often a complete waste of time, money and resources. The big advantage of ADR, particularly mediation, is that not only are the parties in control of the process but they can also, with the assistance of the mediator, design solutions to their dispute that can preserve their business relationship. Never forget that Judges are civil servants; you get to choose your mediator but you have no choice over which judge you get. In my view only a mad person would choose litigation over mediation. Q. With the rise of the superyacht and heightened media interest seeing an increase in headlines every year, how do you manage the critics? We take a very strict approach to confidentiality; criticism from the general public is not something we often have to deal with. It’s in our own best interests as well as our clients’ that we generally stay out of the public eye. Q. In your 34 years’ experience in law, what were some of the memorable and most challenging events so far in your career? The most challenging and exciting event was starting BM in 2004. It was a leap in the dark, and very hard work, but the challenge was very worthwhile and the last 11 years since the firm’s foundation have been the most rewarding of my life. Q. As one of the world’s leading superyacht law firms, how do you keep one step ahead of the game? I think the root of our success has been a joint emphasis on the quality standards that we insist upon and the personalised way in which we deliver our services. We also have a young, talented and highly driven team that believes in those principles. Q. What does success mean to you? Happy clients. Q. If you could choose one yacht, any yacht to be in possession of yourself, which would you choose? My ideal yacht has not yet been built, but if it is, I’ll let you know. Q. Is it all sun, sea and superyachts? In short, no – that’s the preserve of the owners! The vast majority of our work is very similar to that of most practice areas; we spend a lot of time poring over contracts, articles and the latest case law. However, my team and I do travel from time to time to various yacht shows or closing meetings. Monaco, Fort Lauderdale, Cannes and various spots in Italy are popular destinations! COVER

- 23. 23 Gamechangers Bargate Murray, Business Lawyers Tel: (switchboard): +44 (0) 20 7375 1393 Fax: +44 (0) 20 7392 9529 Email (general office) info@bargatemur- ray.com Our Website: www.bargatemurray.com On Facebook: https://www.facebook.com/bargatemur- ray COVER

- 24. Gamechangers 24 The man behind the brand... Which three people would you most like to invite to a dinner party? Arnold Schwarzenegger, James Caan, and Sigourney Weaver. What is your most used phrase in both work and play? It is clear beyond peradventure. Who outside of your field of interest inspires you and why? John Cleese (as Basil Fawlty) because he proved that success & madness are not mutually exclusive. What animal do you take the most inspiration from? Border Terrier because it’s bright, tough and very loyal, just like me! Most common thought when you first wake? WHERE’S THE BACON? The last thought before you sleep? Did I finish the bacon? What song, film or literature best describes your life? 2001 – A Space Odyssey. Full of mystery and very unpredictable. What makes you howl with laughter? Politicians, because of their desperate attempt at false sincerity. Ocean bed or outer space? Outer space. Have you ever stolen a pen from work? Of course, who hasn’t? But in my case, as I own all the pens (and have eaten all the pies) it doesn’t really count. “What makes you cry or angry? An unpaid invoice” COVER

- 25. Gamechangers

- 26. Gamechangers 26 10 Best Countries In The World For Starting And Running A Business “Today, the pressure is on economies because the other drivers of growth are not doing well” The World Bank’s ‘Doing Business 2016’ report was recently released – as the most authoritative source in the world for which countries are most friendly to entrepreneurs, and where’s it’s least onerous to keep an enterprise running, we’ve laid out which countries are in the very upper end of the ranks. Also documented is where they were last year, and where they were five years ago, in the 2011 index. The World Bank calculates its own score for each country, based on the “distance to fron- tier” (DTF). That tracks how far each country is from the best ever score for a number of differ- ent measures. Those measures include things like how long it takes to get necessary permits, how long it takes to establish a business, and how burdensome the regulatory and tax envi- ronments are. It’s one of the most well respected indexes on economic performance in the world, and there’s fierce competition for a place in the upper ranks. Rather than create more attractive business climates to spur souring growth prospects, many of the world’s largest economies may actually be making it more difficult to start and run a company. Almost half of the Group of 20 largest economies have fallen in the World Bank’s annual “Doing Business” rankings, including emerging markets such as China, Turkey, South Africa and Brazil that most need economic over- hauls to revive growth prospects. The World Bank’s flagship report on the best and worst places to start and operate a business in 189 economies around the globe underscores the inability of many governments to make needed policy changes. Global growth is settling into a long period of anemic expansion as large emerging markets. Those troubles are rippling out across the globe, jeopardizing prospects for rich and poor countries alike. G-20 nations have vowed to restructure their economies to make them more competitive and attractive to invest- ment, but have so far failed to deliver on their promises. Ballooning government debt levels and central banks that have stretched the fron- tiers of monetary policy are leaving authorities with little ammunition to jumpstart growth. “Today, the pressure is on economies because the other drivers of growth are not doing well,” said Kaushik Basu, the World Bank’s chief economist, in an interview. “So a lot depends on the ease of doing business….There is a much greater need to work on this than before.” The rankings of the 189 economies can be a boon or humiliation to countries around the world seeking to attract more investment. They’re based on a raft of indicators that gauge the business climate, including paying taxes, registering property, and permitting and contract enforcement. Over the last two years, the bank has been updating its metrics, including trying to better measure the quality of regulations. Here’s how the 10 best coun- tries look this year… 10. Finland (from 9th) - despite a drop this year, Finland has improved over the last 5 years, rising from 13th. It sneaks into the top 10, one of 5 European countries that does. 9. Norway (from 6th) - though Norway has slipped a little, it still holds a top 10 spot. It’s only the 3rd best-ranked Scandinavian nation, showing how well that part of the world per- forms. 8. Sweden (from 11th) - the country’s climb in the ranks makes it to the third most busi- ness-friendly country in Europe, and the second most in Scandinavia. 7. United States (unchanged) - the world’s biggest economy still holds a relatively high spot, but has lost ground relative to 5 years ago, when it came in 5th. 6. United Kingdom (from 8th) - home to Eu- rope’s biggest financial centre, the UK was cred- ited by the World Bank for a cut in corporation tax, and comes second in terms of European countries. 5. Hong Kong (from 3rd) - China’s premier fi- nancial city and an access gateway for western- ers, Hong Kong has slipped down the rankings. As recently as 2011, it vied with Singapore for the top spot. 4. South Korea (from 5th) - in recent years South Korea has become much more business-friendly, according to the World Bank, rising from 16th just 5 years ago. 3. Denmark (from 4th) - this country tops the list for European countries, and has quietly climbed from 6th in the last 5 years. Though it’s known for its Scandinavian-style welfare state, it’s a dynamic business-friendly economy too. 2. New Zealand (unchanged) - this tiny economy has become a model to emulate in terms of its approach to start-up business. On the World Bank scoring system, its now less than one point away from the overall winner. 1. Singapore (unchanged) - this financial hub went through a dramatic growth period during the 20th century, and has now topped the World Bank Ranks for 10 straight years. WORLD VIEW

- 27. 27 Gamechangers Kaushik Basu, the World Bank’s chief economist WORLD VIEW

- 28. Gamechangers 28 Iceland is the safest country in the world, while Syria is the most dangerous, the latest report from the Institute for Eco- nomics and Peace has found. The rankings were based on 23 different metrics, taking into account statistical factors such as murder rates and military expenditure, but also including perceptions of criminality within states and terrorism levels. The metrics are combined into a single number, called the Global Peace Index (GPI). The lower the number, the safer a country is regarded. WORLD VIEW The 10 safest countries in the world – and the 10 most dangerous UK ranked 39th most peaceful country in the world in ninth edition of Global Peace Index rankings

- 29. 29 Gamechangers WORLD VIEW The report, released annually, ranked Syria as the 88th most peaceful country in 2008, out of 162 total nations. However, the outbreak of civil war and the rise of Islamic State (IS) have caused its peace ranking to shoot through the floor, according to The Independent. Syria earned a GPI of 3.645. The ten least peaceful countries in the world Syria Iraq Afghanistan South Sudan Central African Republic Somalia Sudan Democratic Republic of Congo Pakistan North Korea Iceland, by contrast, earned its rank from a low level of militarisation and conflict both domes- tically and internationally. Iceland is one of few countries in the world – and only Nato member – without a standing army. The closest agency it can deploy is the coastguard. Factors such as these earned Iceland the lowest GPI, at 1.148. Nordic countries and Alpine states including Austria and Switzerland rank highly on the list of most peaceful countries – Denmark sits in second place, and Finland in sixth. Sweden and Norway are 13th and 17th, respectively, due to their higher crime levels and weapons exports; Sweden prefers to stay neutral in conflicts, yet is the 12th largest exporter of weapons in the world. The ten most peaceful countries in the world Iceland Denmark Austria New Zealand Finland Switzerland Canada Japan Australia Czech Republic The UK came in 39th place, due primarily to higher perceptions of criminality and a greater threat of terrorist attacks, according to the Independent. Being a nuclear state is also a detriment to its rank. The ten least safe countries in the world are comprised primarily of states in the Middle East and north and central Africa. These states suffer from frequent bouts of civil war and the effects of the “War on Terror”. North Korea also made the bottom ten. This is the ninth edition of the GPI report. Over the past eight years, the average country score has fallen by 2.4 per cent, indicating that, by and large, the world is becoming less peaceful.

- 30. Gamechangers 30 London’s Corporate Tech Boom - Have We Learnt Past Lessons? London is currently at the heart of one of the most significant corporate trends – a global tech boom that is transforming ambitious start- ups into billion dollar “unicorns”. And with memories of the late-nineties dot-com bubble still fresh, the key question for City investors is this: have lessons been learnt, or are we due a sharp correction? Firstly, there are clear differences between the two markets. At its heart, the dot-com boom was driven by companies rooted in conventional models which offered little more than digital windows to “old world” businesses. In many cases, projected revenue growth never materialised and investors rapidly lost confidence in their bullish valuation multiples. In contrast, the best of the companies leading today’s tech boom are set apart from the dot-com darlings by their disruptive business models that address real consumer desires, build strong communities, and reject “status quo” solutions. Taking three examples of London- based companies that have recently completed successful investment rounds, TransferWise has pioneered a new way of transferring money that has slashed remittance costs for its users, Farfetch has given consumers access to a previously cut-off global network of luxury designer boutiques and Funding Circle, just one of several successful peer-to-peer lending ventures, has radically challenged the classical bank finance model. Valuations of these companies may be seen as aggressive, but are ultimately underpinned by deep user bases, solid revenues and “proven” concepts, in contrast to the raft of tech companies that went from inception-to-IPO at breakneck speed in the late 1990s. That said, investors should take stock of the current market. Many private equity and venture capital houses are sitting on significant pots of “dry powder”, built up during a re- invigorated fundraising market and a hot exit climate over the last 18 months. And with quality assets often heavily outnumbered by willing investors, prices are being forced upwards. Investors must therefore be smart in getting to know the market ahead of their rivals, but alert to the dangers of over-paying for assets that have achieved full market exposure. They should also consider the pitfalls inherent in investing in highly digitised markets. Until companies reach critical mass and build up considerable brand loyalty they remain vulnerable to new market entrants – see, for instance, Uber’s challenge to Addison Lee in the “on demand” transport sector. Corporates seeking to leverage M&A opportunities in the tech sphere should take inspiration from recent successes, whilst heeding warnings from the dot-com boom, such as the now-infamous AOL Time Warner tie up that sought to combine wholly disparate business platforms. Successes such as the purchase of Zoopla (an online property window) by Daily Mail General Trust (the publisher) and Countrywide (the bricks-and-mortar estate agency) show that in order to build real value, strategic acquisitions must be underpinned by industry know-how and demonstrable synergies rather than sentiment. With a mature investment and exit network and strong professional services support platform, London is undoubtedly well placed to continue to drive (and benefit from) the corporate tech boom. Numerous home-grown companies are using technology to implement genuinely revolutionary business models that are shaking up established markets and delivering real value to their investors. We’re in a very different place now than we were 15 years ago – but must nevertheless recall past mistakes to ensure they aren’t repeated. Andrew Wingfield, Partner and Matt Clift, Associate from the London Corporate Finance Team of International Law Firm, King & Wood Mallesons WORLD VIEW

- 32. Gamechangers 32 UNIVERSITY OF EDINBURGH SECURES UK’S FIRST RISK AND RESILIENCE INNOVATION SHOWCASE • AIMday event will provide a pathway to find solutions that will ‘Future-Proof’ business, helping companies to safeguard the bottom line and maintain competitive edge • This is the first time that AIMday has looked at ‘Risk & Resilience’ - a topic that is becoming central to boardroom discussions globally today. • Company registration now open for unique 27th January business - academic showpiece WORLD VIEW

- 33. 33 Gamechangers Edinburgh Research and Innovation, the commercialisation arm of the University of Edinburgh, has announced a new AIMday® (Academic Industry Meeting day) for companies looking to anticipate possible future risks to their operations and plan resilience strategies for today’s global marketplace. AIMday Risk & Resilience will tackle topics such as risk & financial decision making, management risk in day to day operations, strategic resilience, regulatory issues and climatic risk. Risk & Resilience - terms that have become increasingly commonplace in boardroom dis- cussions - places greater emphasis on planning for dramatic economic or climatic changes and technological advances that could have repercussions for companies, their customers, employees and supply chains within the compet- itive market environment. AIMday is a one-day event that allows com- panies to submit a question or commercial challenge around any element of Risk and Resil- ience. Academics from across the University, will self-select those questions where they believe their research could add the most value to the company discussion. On the AIMday itself, the companies and academics meet in a one-hour workshop face to face to discuss possible pathways to a solution - the emphasis being on generating innovative ideas to meet today’s challenges using multi-dis- ciplinary approach. Douglas Graham, Commercial Relations Exec- utive, University of Edinburgh Business School comments; “The announcement of an AIMday focused on the topic of Risk & Resilience coincides with increased emphasis on the identification and management of risk in industry today. With companies increasingly looking to meet global market demands, universities are a vital source of knowledge on this topic. This AIMday event will provide a source of innovative and multi-dis- ciplinary thinking to companies who are looking to protect their supply chains, investments and bottom line well into the future. “Today, it is important that organisations embed risk management strategies into their day-to- day operations. Supply chains are increasingly outsourced, therefore, companies need to understand, anticipate and plan for strategic resilience in order to safeguard their bottom line and competitive edge. “I am delighted the University of Edinburgh is hosting what will be a compelling and infor- mative AIMday and we’re looking forward to a good level of engagement particularly from the public sector, financial services and construction industries amongst many others.” The event will be held on 27th January 2016 at the University of Edinburgh Business School and will allow companies to access the interdisciplin- ary strength and depth of expertise across the University of Edinburgh’s three Colleges of Hu- manities & social science, Medicine & Veterinary Medicine and Science & Engineering. In 2014, The University of Edinburgh became the first higher academic institute outside Scan- dinavia to be approved as hosts for AIMday® – a unique collaborative knowledge exchange initiative which began life at Uppsala University in Sweden This is the sixth AIMday to be organised by Edinburgh Research and Innovation (ERI) at the University of Edinburgh, an event which is prov- ing successful in establishing useful contacts and collaborations, as well as identifying possible new solutions to challenges facing organisations today. Companies can register and submit their ques- tions or challenges until 30th October 2015, at which point academics will be able to select those questions their research is most closely aligned to. Interested companies can find out more at http://aimday.se/risk-resilience-edinburgh-2016/ WORLD VIEW